Indian Energy Imports to Exceed $400b by 2020 Doubling GHG Emissions

JUST 12 MONTHS IMPORTS BILL IN 2020 COULD FINANCE ALL OUR 200,000MW HYDRO PROJECTS, 60,000 MW OF NUCLEAR POWER.

Reading just two TNN stories it can be easily concluded Indian companies had invested or already committed to invest over $100b in Oil & Gas, Coal and Energy sector in foreign countries. Reliance Power, Adani Power, Lanco Infratech and GVK acquired Coal Mines having over 25.1 Billion Tones of coal reserves with 500m tones peak Coal Extractions annually – this doesn't include other Indian power, power, steel, mining & oil & gas companies investing in foreign energy sector, so it can be concluded in all over $100b in foreign investment is already committed and $50b coming up this year.

Energy & Minerals resources acquired by Indian Companies in foreign countries could be worth $20,000b but India is Enslaved When Required to Import $400b Worth of Energy by 2020 and neglecting Indian economy.

http://www.google.com/finance?q=NYSE:VLO&fstype=ii

In addition RIL alone is in the process of bidding Valero Energy for $27b that may eventually go up to $50b over and above its other foreign acquisitions. As per latest financial statement Valero Energy profit margin after tax is barely 1%. This adds up to over $150b.

But unlike State Owned Chinese Companies acquiring foreign energy & mining concessions Indian companies are privately owned who are neither committed to ship Coal and Oil & Gas to India nor profits in operations.

India is neglected in the process and virtually Promoting Loot –

1. There is little investment in developing Coal & Oil & Gas in India, 150 million tones of iron ore is/was being exported at mining cost of Rs.600 per tone – a tenth of export price.

2. By 2014 India is committed to Import 180 million tones of coal annually at landed and transport cost exceeding $150-$200 per tone, when mining cost of Coal in India is just $10 per tone to $20 per tone and all internal costs. This is Energy Loot by private companies – fuel cost per unit of electricity would go up from Rs.2 to Rs.5 from imported Coal. Against average realization of Rs.3 per unit new generation cost shall be Rs.9 per unit to over Rs.10 per unit and more due to inflation.

3. Private sector has invested $13b in adding just 13,000MW of Thermal Power in last six years and real investment in Oil & Gas is not even $5b since 1999 – 80% of new generation capacity is being contracted on Engineering Procurement & Construction basis to Chinese companies.

4. By 2020 India may be importing 500m tones of coal annually worth $100b and together with Oil & Gas energy imports may exceed $300b to $400b.

5. When Central & State owned Energy Companies are starved of resources over $150b already committed in foreign countries, India is depending on private companies to import Energy worth over $400b annually by 2020.

India could be Rich Prosperous yet Clean & Pollution Free but RSS BJP Bania nexus is hindering any progress is determined to Cripple GOI and Enslave 1200m Indians.

· RSS BJP Bania nexus led by L.K. Advani SABOTAGED Nuclear Power, Hydro Power openly because these sectors are largely reserved for State & Central sector.

· They don't want to Protect Intellectual Property of Indians.

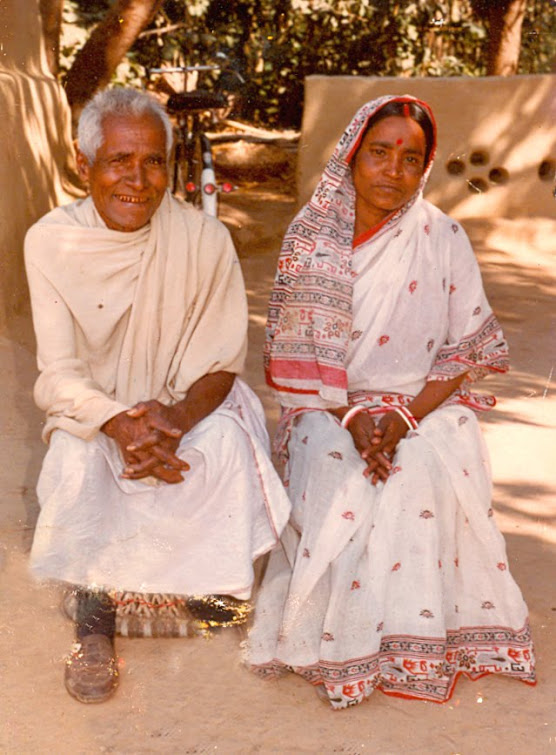

Ravinder Singh

Inventor & Consultant

October30, 2011

References

http://www.cea.nic.in/archives/exec_summary/jan05.pdf

http://www.cea.nic.in/reports/monthly/executive_rep/sep11/27-33.pdf

Private sector installed capacity Thermal Power in Jan2005 was 8998 MW that has gone up to 22747 MW or roughly 13,000 MW.

RIL spurts on Valero takeover reports

Piyush Pandey TNN October29, 2011

Mumbai: Reliance Industries may be in talks to acquire US refiner Valero Energy Corp valuing the latter at $27billion, according to international media reports. RIL may bid $48 per share for the largest US refiner, which is a mighty 85% premium to the Valero's current share price of $26 per share, said UK's Daily Mail newspaper on Wednesday.

Shares of Valero gained18% since the news surfaced to close at $26 in New York on Thursday while RIL shares gained 2.82% to close at Rs 898 in a strong Mumbai market on Friday. The report assumes significance as RIL chairman Mukesh Ambani has asked investment banks Goldman Sachs and JP Morgan to identify significant acquisition targets in the US. But several international analysts covering the sector have expressed skepticism, especially at the significant premium that RIL would reportedly cough up for such a transaction. Valero's shares are still quoting well below $30, which would not be the case, if the bid news was true, said a section of the analysts.

Both RIL and Valero spokespersons in an email reply to a query by this paper declined to comment, saying it's against their company policy to comment on speculation.

Investment advisor S P Tulsian believes that RIL is in position to fund acquisition of this size with $12.6 billion of surplus cash reserves. "If the deal is happening at $48 per share valuing Valero at $27 billion a majority of 51% stake with management and control will cost RIL less than $15 billion."

Valero Energy owns and operates 15 refineries stretching from California toCanada to the Caribbean, with a combined capacity of processing over two million barrels per day (bpd) of crude oil.

The foreign acquisitions are being looked at to strengthen RIL's core businesses and the company has found that the economic downturn has created some right-valued acquisition opportunities. However, RIL has been conservative when it comes to its acquisition strategy.

The emergence of Indian coal barons

Piyush Pandey TNN October28, 2011

Mumbai: What is common between Anil Ambani, Gautam Adani, Madhusudan Rao and G V K Reddy? In a race to secure coal assets to fuel their power plants, these billionaires are fast emerging as global coal barons. The companies that they run – Reliance Power, Adani Power, Lanco Infratech and GVK – will feature among the top 10 coal miners in the world, behind Peabody and Shenhua Energy, once they start coal production in coming years.

Peabody Energy, which claims to be the world's largest private sector coal producer, had registered sales of 246 million mt in 2010 and Shenhua Energy's coal production is pegged at 256 million mt according to its website. However, government-owned Coal India is the world's single largest coal producer with an annual production in excess of 430 million mt. At peak production, some of these Indian firms will have excess coal production compared to such global miners as Rio Trinto, Anglo American, Xstrata, Russian Suek and Indonesian Adaro. Adani, with a resource base in excess of 8 billion mt of coal, plans to produce 200 million mt per annum at peak production, while others plan to produce over 100 million mt per annum each in the coming years.

Increasing Imports: In spite of having the world's third biggest coal resources after US and China, Indian firms are aggressively acquiring coal assets overseas as most of Indian coal reserves lie in forest areas and cannot be mined for environmental concerns. Indian coal imports are, therefore, seen rising against a stagnant output and rising demand. Total coal imports in 2010 were 55 million mt, which is likely to climb to 186 million mt by 2014 because of aggressive ramp-up plans by steel and power companies. Michael Cooper, associate editor, Platts International Coal Report, has another reason.

"The quality of thermal coal in India is of very low calorific value with high ash content compared to imported coal, which has comparably higher heating values and, when burned, increases power station boilers' efficiency."

Global Acquisitions: Indian firms have already spent over $10 billion to acquire coal mines overseas and are likely to invest a similar amount in coming years. Adani acquired Linc Energy's Queensland coal tenements in a deal valued at $2.72 billion and agreed to pay another $2 billion in cash for the Abbot Point terminal near Bowen to secure coal delivery.

Similarly, Reliance Power has acquired three coal mines in Indonesia with total reserves of 2 billion mt. The company plans to further invest $500 million to ramp up capacity. "With reserves in excess of 4 billion mt in India and overseas, no doubt we will be among the top 10 coal miners in the world with an annual production of 100 million mt in coming years," Jayarama Prasad Chalasani, Reliance Power CEO, told TOI.

G V Krishna Reddy of GVK Group has also joined the premier league of coal barons. His latest $1.26-billion acquisition in Australia will give him access to 8 billion mt of coal reserves to fuel GVK's power projects in India. Another power company, GMR Energy, had in August agreed to buy a 30% stake in PT Golden Energy Mines for $550 million. The company had earlier acquired an Indonesian coal company PT Barasentosa Lestari for $100 million.

Others like Lanco with captive coal reserves of 2 billion mt are still scouting opportunities. "Recently, we acquired Griffin coal in Australia for $750 million. We are building a pipeline for acquisitions in Indonesia, Africa and Australia," K Naga Prasad, Lanco's chief executive (business development) told TOI. Cooper believes that, going forward, Indian firms will continue to acquire overseas coal assets aggressively. "India has ambitious plans to expand it steel-making and power-generating capacity and, if its domestic production cannot match this, then it will have to source this coal from overseas or otherwise reduce its targets for steel production and electricity generation," Cooper added.

Undervalued Share Prices: Indian infrastructure companies may secure the the top 10 global positions by chasing the black diamond overseas, but when it comes to valuations, the stocks of these companies have taken a severe blow. The fact that shares of Lanco Infratech, Adani Power and Reliance Power are available for discounts of 33% to 75% is because the markets have taken a weak view of their overleveraged acquisitions, litigations and regulatory clearances and possible impact of carbon tax abroad.

No comments:

Post a Comment